McNair Center Intern Shelby Bice attended the Grace Hopper Celebration of Women in Computing Conference along with 18,000 other computer scientists on October 4-6, 2017 in Orlando, Florida.

The Grace Hopper Celebration honors the legacy of Grace Hopper, a trailblazer in computer programming who led the team that developed the first programming language, a precursor to COBOL. The conference is organized by The Anita Borg Institute for Women and Technology, a nonprofit organization founded in 1987 by computer scientist Anita Borg. It is an event to recruit, retain, and advance women in careers in computing and technological innovation.

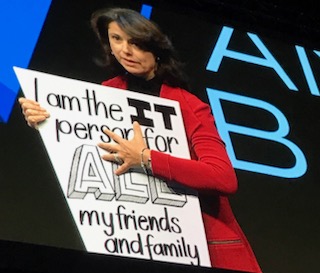

The Grace Hopper Conference brings together companies ranging from small startups to tech giants. All are looking to recruit talented computer scientists and engineers. The event also includes panels on topics such as new applications for artificial intelligence and formulating an elevator pitch. In many ways, Grace Hopper resembles any other tech conference. However, there is one crucial distinction: the majority of the panelists, presenters and representatives are women.

What makes the Grace Hopper Celebration so important?

First and foremost, the Grace Hopper Celebration reminds the tech industry that female engineers not only exist, but that they are also just as hardworking and capable as their male counterparts.

When companies like Uber face backlash for low female representation, they often blame a lack of women in the industry. A recent article in the Wall Street Journal reports Uber’s laughable finding that only 1,800 women engineers might be qualified to work for Uber. However, tickets for the celebration sold out within hours due to high interest from female computer scientists across the country. It seems safe to say that there are more than 1,800 women who meet Uber’s standards, regardless of their rigorousness.

The conference exposes women at different career levels to the vast array of careers in computer science. The stereotype of a lone male programmer sitting in a dark room coding video games is not an accurate depiction of computer science. Despite the many areas in which female engineers can apply their skills, many women are often unaware of available opportunities.

Grace Hopper showcases juggernauts like Google and Microsoft alongside smaller, lesser-known startups. The conference embodies the interdisciplinary and dynamic nature of computer science. For instance, Grace Hopper piqued my interest in Flatiron, a company that partners with oncologists to analyze data and recommend better cancer treatments.

Most importantly, Grace Hopper celebrates women in computer science. According to the WSJ, the percentage of female computer scientists in industry fell from roughly 37% in the mid-1980s to 18% in 2014. With only minimal gains since 2014, leaders must make a conscious effort to bring more women into the field. It’s also just as important to keep female computer scientists engaged and fulfilled throughout their careers. Many female computer scientists leave technical positions due to a lack of support from their company or, sometimes, gender discrimination. The Grace Hopper Celebration combats these negative forces by fostering an inclusive community.

Going forward

The Grace Hopper Celebration is just one step that the tech industry can take to empower women in computer science. After listening to the inspiring experiences of female computer scientists, entrepreneurs, researchers and leaders, I am confident that events like the Grace Hopper Celebration can help resolve the gender imbalance in computer science.

Grace Hopper will be coming to Houston in 2018. I look forward to attending!

t. Louis’ ecosystem unique.

t. Louis’ ecosystem unique.

Over the last decade, Blake Commager (

Over the last decade, Blake Commager (

Legislation passed during the first three months of the 115th Congress pays disproportionate attention to entrepreneurship and innovation. McNair Center research shows that in a typical congressional session, less than 2 percent of legislation introduced is relevant to E&I issues. As of March 23, three of the

Legislation passed during the first three months of the 115th Congress pays disproportionate attention to entrepreneurship and innovation. McNair Center research shows that in a typical congressional session, less than 2 percent of legislation introduced is relevant to E&I issues. As of March 23, three of the