In the past few decades, there has been a decline in manufacturing jobs in the United States. Companies have been able to produce goods abroad at a cheaper price due to lower labor costs in developing countries.

Incubators are crucial to the revitalization of U.S. manufacturing. The Fulton-Carroll Center Incubator in Chicago is one of the largest and first manufacturing incubators in the nation. It was established in 1980 with $2.6 million in grants from the federal government. In 2015, the city of Seattle awarded the Industry Space Seattle, a manufacturing incubator started by Johnny Bianchi in 2015, a grant of $100,000.

Importance

Traditional startup incubators provide office space, network access and business advice for tech companies developing things like software and apps. Startups usually pay a monthly/annual membership fee, or pay monthly rent at a rate determined by the incubator. The rent is usually slightly more expensive than what companies need to pay to get a similar office in the same area. However, extra value comes from access to the incubator’s resources. Costs are shared among multiple startup companies, as well as by the incubator sponsor. Sponsors can be nonprofit or for-profit entities.

Incubators are perhaps even more important to the manufacturing industry than to the tech industry. Manufacturing firms require more expensive machines and tools, in addition to basic resources. Incubators that provide those technologies are especially important for manufacturing startups that aren’t ready to invest in their own infrastructure yet.

Providing Equipment

Chicago’s mHub, opened in March 2017, is an innovation center for physical product development and manufacturing. mHub is equipped with ten labs, including a 3D-printing lab, fabrication labs, electronics labs, plastic molding, textiles, welding and grinding, wood shop and wet lab. Overall, they provide a total of more than $2.5 million of prototyping and manufacturing equipment.

Industry Space Seattle gives its tenants the use of 10 overhead crane systems, which can cost up to $80,000 each, along with a $30,000 compressed-air system, a $20,000 forklift and an industrial paint booth.

MHub in Chicago

Other Resources

In addition to the machinery and tools, incubators provide manufacturing startups with general business resources. The Industry Space Seattle partners with Impact Washington. Impact Washington is a nonprofit that provides consulting services and business mentoring to fledgling manufacturers.

The Advance Business & Manufacturing Center Incubator, a program provided by the Greater Green Bay Chamber in Wisconsin since 1987, partners with local universities, who connect college students to startups when extra manpower is needed. When multiple firms work in close proximity, they share knowledge and inspire each other with ideas. The business networking at incubators can also foster collaboration and expansion.

Structures of Manufacturing Incubators

The sizes of manufacturing incubators can range from less than 100,000 square-foot to the size of a city block. On the smaller side, the Industry Space Seattle provides up the ten industrial working spaces, while mHub can serve hundreds of startups at one time.

Although these incubators provide machinery for manufacturing, not all of their client companies are in the manufacturing industry. Startups service companies, ranging from non-profits to law firms to consulting firms, can rent out only the office space at a cheaper price.

Incubator Sponsors

The up-front investment in a manufacturing incubator is expensive. Although most are sponsored by the government, there are individuals who started an incubator because they believe that incubators offer talented minds chances to succeed. Bianchi bought and renewed a building into Industry Space Seattle because “there’s a whole bunch of people operating out of garages trying to legitimize their business [and] it’s financially infeasible to grow them.” Elissa Bloom started a fashion incubator because “there’s so much talent in the city, but they’re not getting the know-how to run and launch a business.”

Trends and Barriers

The long-term trend in U.S. manufacturing is of more automation to increase productivity with fewer workers. This trend favors larger manufacturers who can afford the capital investment needed to remain competitive. In recent years though, technologies like 3D printing, CNC laser cutters and other CAD/CAM equipment, have reduced the price and time needed for prototyping and development. There are therefore now lower barriers to entry to new product development in manufacturing, providing firms have access to the necessary technologies.

Conclusion

Manufacturing incubators take advantage of economies of scope and scale by providing capital equipment to manufacturing startups. This works because a typical piece of equipment will be mostly idle even at a fairly large single firm. Manufacturing incubators have also borrowed some best practices from startup incubators. In particular, they often provide broader business services and access to networks.

However, manufacturing incubators are a recent phenomenon. They are still on their first evolutionary cycle and their funding is largely not tied to their performance. Startup ecosystem participants, by comparison, have now faced almost a decade of competitive pressures. Competitive pressures select business models and niches that are aligned with market needs. Manufacturing incubators will likely become more successful when they partner with industry incumbents. A first step towards this is to sponsored by local for-profit firms.

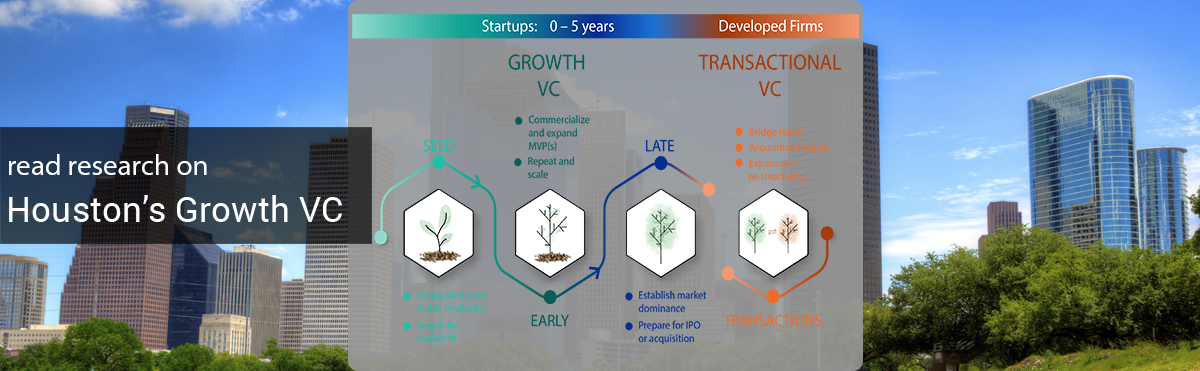

Houston’s high-tech ecosystem can only flourish if it attracts more growth venture capital investments, according to the latest McNair Center for Entrepreneurship and Innovation issue brief, “

Houston’s high-tech ecosystem can only flourish if it attracts more growth venture capital investments, according to the latest McNair Center for Entrepreneurship and Innovation issue brief, “